Hsmb Advisory Llc - The Facts

Hsmb Advisory Llc - The Facts

Blog Article

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Table of ContentsTop Guidelines Of Hsmb Advisory LlcLittle Known Facts About Hsmb Advisory Llc.Facts About Hsmb Advisory Llc RevealedThe Of Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?The Best Guide To Hsmb Advisory Llc

Ford says to avoid "cash money worth or long-term" life insurance coverage, which is more of an investment than an insurance. "Those are really made complex, included high compensations, and 9 out of 10 people do not need them. They're oversold because insurance representatives make the largest compensations on these," he states.

Special needs insurance can be pricey. And for those who choose for long-lasting care insurance policy, this plan may make impairment insurance policy unnecessary.

The Hsmb Advisory Llc PDFs

If you have a persistent health and wellness problem, this kind of insurance coverage could wind up being crucial (Life Insurance St Petersburg, FL). Don't allow it worry you or your financial institution account early in lifeit's generally best to take out a plan in your 50s or 60s with the expectancy that you won't be utilizing it up until your 70s or later on.

If you're a small-business owner, take into consideration shielding your source of income by purchasing business insurance coverage. In case of a disaster-related closure or duration of rebuilding, organization insurance coverage can cover your revenue loss. Take into consideration if a considerable weather condition occasion affected your storefront or manufacturing facilityhow would certainly that affect your revenue? And for exactly how long? According to a record by FEMA, between 4060% of little services never ever reopen their doors complying with a disaster.

And also, utilizing insurance coverage might often set you back even more than it saves in the lengthy run. If you get a chip in your windshield, you might consider covering the repair work expenditure with your emergency cost savings rather of your automobile insurance policy. Insurance Advisors.

Some Known Factual Statements About Hsmb Advisory Llc

Share these ideas to protect loved ones from being both underinsured and overinsuredand talk to a relied on specialist when needed. (https://hsmbadvisory.blog.ss-blog.jp/)

Insurance policy that is bought by a specific for single-person protection or protection of a household. The private pays the costs, instead of employer-based health and wellness insurance where the company usually pays a share of the costs. People may shop for and acquisition insurance from any strategies offered in the person's geographical region.

Individuals and family members might qualify for monetary support to lower the expense of insurance policy costs and out-of-pocket prices, yet just when enrolling through Link for Wellness Colorado. If you experience particular adjustments in your life,, you are eligible for a 60-day period of time where you can sign up in a private strategy, even if it is outside of the annual open enrollment period of Nov.

15.

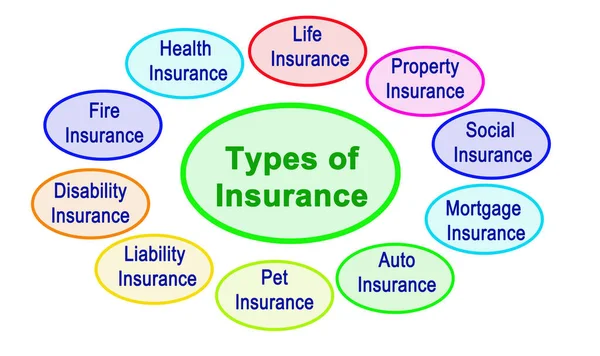

It might go to this web-site seem simple but comprehending insurance coverage types can additionally be perplexing. Much of this confusion comes from the insurance market's ongoing objective to design individualized protection for policyholders. In making flexible policies, there are a range to choose fromand every one of those insurance kinds can make it hard to comprehend what a certain policy is and does.

What Does Hsmb Advisory Llc Do?

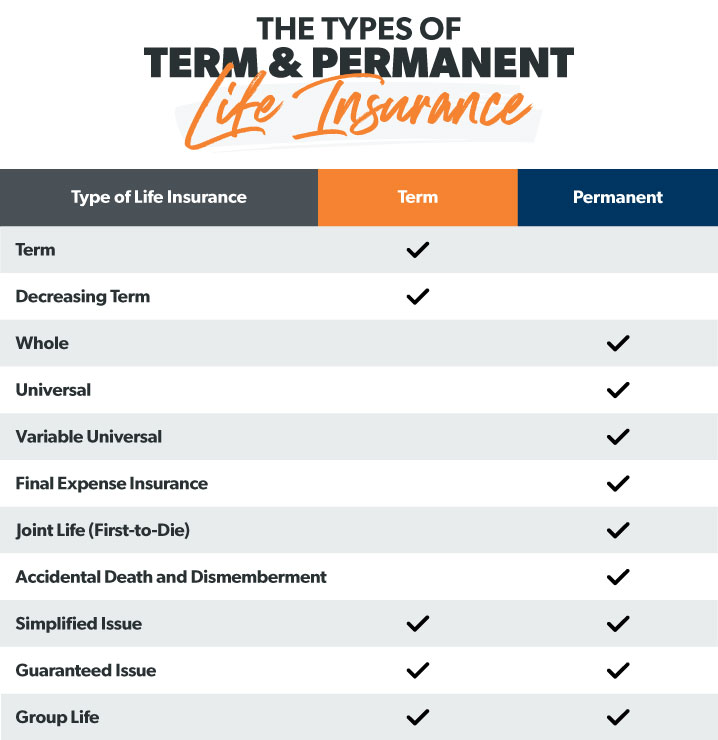

The most effective place to begin is to discuss the difference in between both types of basic life insurance policy: term life insurance policy and permanent life insurance. Term life insurance policy is life insurance that is just active temporarily period. If you die throughout this duration, the person or individuals you have actually named as recipients might get the cash payout of the plan.

Nevertheless, numerous term life insurance policy policies allow you convert them to a whole life insurance policy policy, so you don't lose insurance coverage. Typically, term life insurance policy plan premium settlements (what you pay each month or year into your plan) are not secured in at the time of acquisition, so every five or 10 years you possess the plan, your premiums might climb.

They additionally have a tendency to be more affordable total than whole life, unless you acquire a whole life insurance policy when you're young. There are additionally a few variations on term life insurance policy. One, called team term life insurance coverage, prevails among insurance choices you could have accessibility to with your company.

Hsmb Advisory Llc for Beginners

This is generally done at no charge to the worker, with the capacity to buy added insurance coverage that's taken out of the employee's income. An additional variant that you may have access to with your company is supplementary life insurance policy (Life Insurance St Petersburg, FL). Supplemental life insurance policy could consist of unintended fatality and dismemberment (AD&D) insurance coverage, or interment insuranceadditional insurance coverage that can assist your family members in situation something unforeseen happens to you.

Long-term life insurance coverage simply describes any type of life insurance coverage policy that does not end. There are numerous types of long-term life insurancethe most typical kinds being whole life insurance and universal life insurance policy. Whole life insurance policy is precisely what it seems like: life insurance policy for your entire life that pays out to your recipients when you die.

Report this page